SEPTEMBER 2022 - REPORT

The rising frequency and intensity of crises calls for new insights

The supply chain workforce has quickly become a key lever for regaining stability. Logistics and manufacturing organizations have always relied heavily on their employees to navigate through periods of complexity created by uncertainty. But in an era of continuous market volatility, the demand on the workforce is even greater.

Prior to 2020, job openings in manufacturing and logistics were greatly influenced by the variability experienced in transportation, namely in ground and ocean freight. And while this continues to be the case, there are new drivers of job growth that contribute to the 10.5 percent increase in transportation and warehousing jobs since February 2020.xii

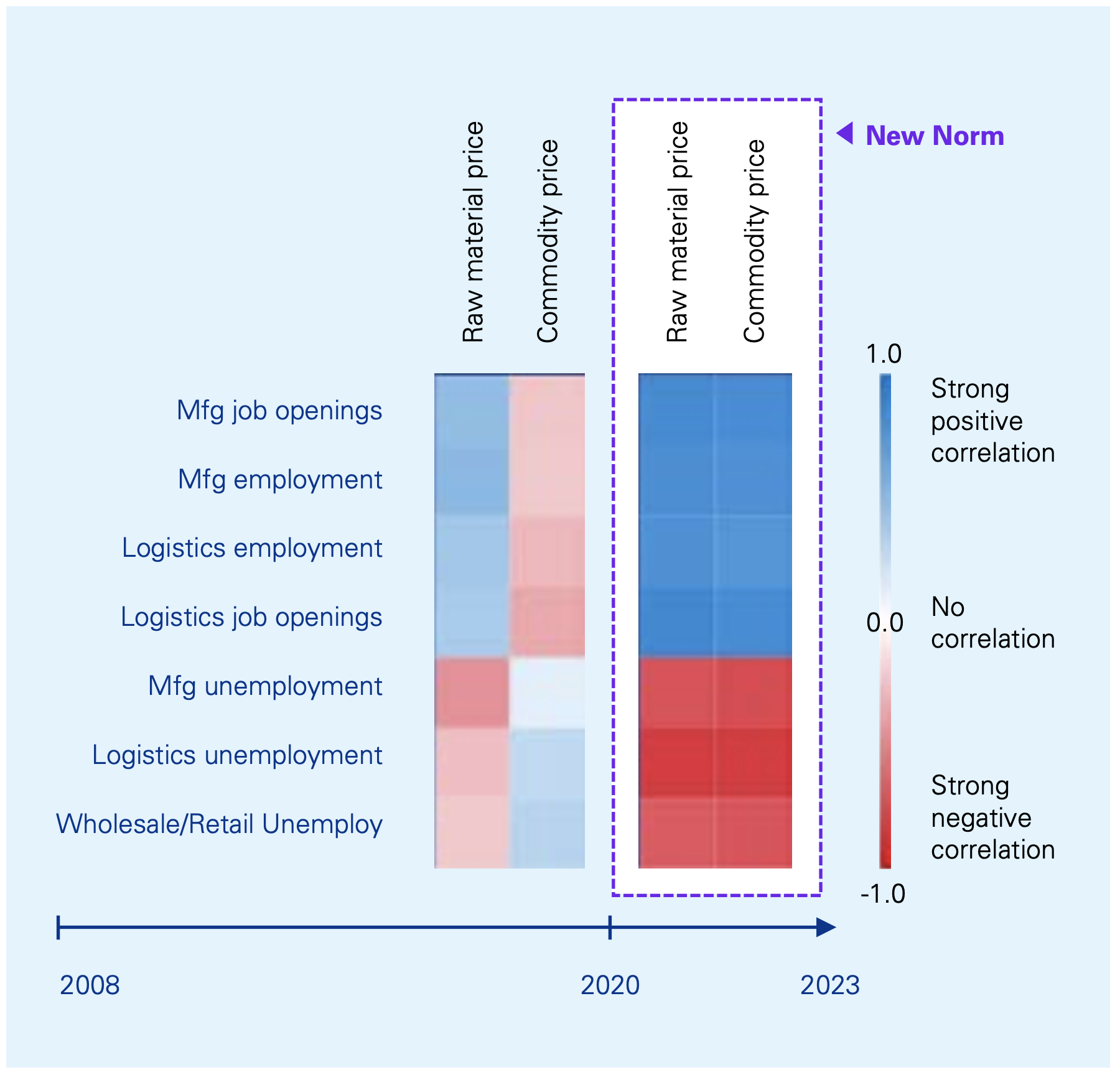

Commodity and raw material price volatility were strong influences on the number of jobs opened over the past two years. Ultimately, setting the right level of organizational capacity and talent in areas such as material sourcing, commodity management, and supplier risk has become key for companies to stabilize supply performance.

The increase in unfilled orders for manufacturers also generated more job openings, as a response to production capacity shortages experienced in the new norm. And a downward trend for inventory to shipment ratios in retail and wholesale industries has created more demand for logistics workers, while companies continue to address the shortage of drivers and crews to move inventory.

xii Jobs report: U.S. employment data shows continuing strong job gains, with employment in the warehousing and transportation industry well-above pre-pandemic levels, Washington Center for Equitable Growth, Apr 2022

Material and commodity price volatility have become indicators of job growth

The new normal of volatility is rendering operations unstable. External market forces are creating mounting pressures across tiered networks and straining execution beyond expected limits. But as with any complexity faced by a supply chain, out of adversity comes opportunity.

Given the scope and magnitude of stress in logistics, it may be some time before operations is able to add capacity at a lesser cost. In the meantime, incremental strategies like asset pooling, may help remediate some of the challenges. Amazon, American Eagle, Gap, and other U.S. companies are doing just that with launches of their own 3rd Party Logistics (3PL) services that offer their network of trucks, warehouses, and inventory systems to the rest of the world.xiii

Utilization of workforce capacity is on a positive trajectory towards stability. Hence, the greater priority is where additional manufacturing and logistic capacity will come from going forward. Labor strategies will require more of a shift from resource utilization to productivity targets, while also accelerating physical and digital automation initiatives. It is no coincidence that the 10-year growth forecast for industrial robots has more than doubled in 2021, from $16 billion to $37 billion.xiv

Supply instability has been on a steady rise over the past two years, due to the direct impact that market volatility has had on supply chain globalization. Assuming a continuation of this trend, commodity and material constraints can only worsen. Many companies should continue to employ alternate strategies to curb supply risk, most of which involves a re-engineering of the supply network or of the finished good itself. General Mills reformulated product recipes when packaging and ingredients became scarce,xv while Tesla rewrote product software to lessen dependency on semiconductors during chip shortages.xvi

xiii Retailers Start Selling Something New: Logistics Services, Wall Street Journal, Sept. 2022

xiv Troubling Trend: Great Resignation Versus AI, Robotics And Automation, Forbes, Jan 2022

xv General Mills reformulates products to combat ingredients shortages, SupplyChainDive, Apr 2022

xvi Tesla rewrites software to get around chip shortages, SupplyChainDive, Jul 2022

©2022 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.